More on the relationship between gold and oil (the "Gold-Oil ratio").

15 June 2020

Further to reading up on statistical research concerning the long-term equilibrium relationship between gold and oil (the research for the most part used cointegration analysis to arrive at their conclusions), the following points lend support to my proposition that the gold-ratio will revert to its 20-year average (see chart below):

1. The long-term relationship between gold and oil typically goes "nuts" during times of crisis (the chart below shows three spikes, all major crises times - 1998/2000, 2008/2009, 2020 so far);

2. Cointegration is present in gold and oil and that this cointegration is "dynamic" in nature. That is, during good times the relationship is strong and during crises it is weak. Market turbulence merely weakens the relationship (as illustrated in the chart below with the spike in the gold-oil ratio in 2020) - it does not destroy or remove it;

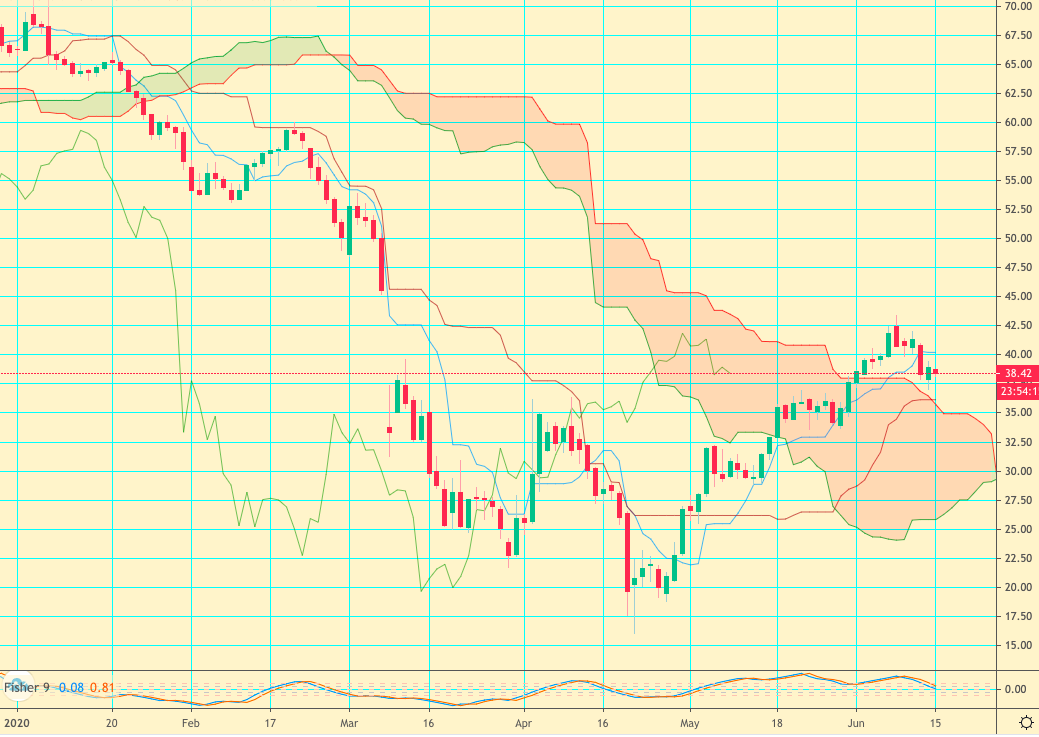

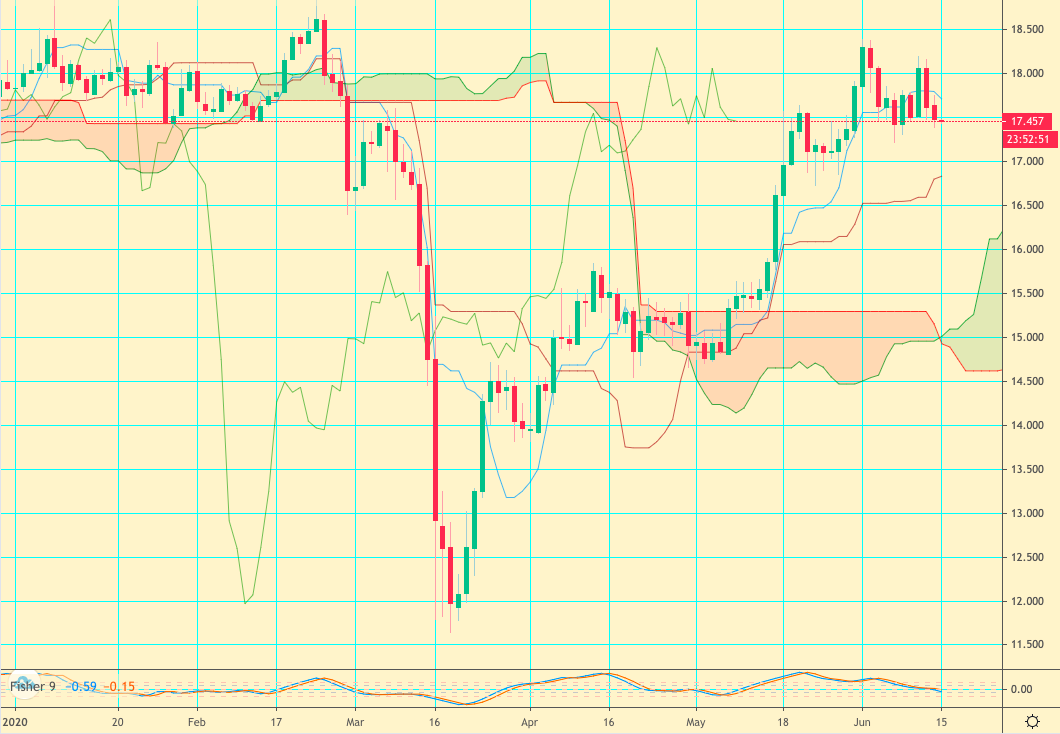

3. And finally, the research suggests that the movement in silver prices leads that of oil prices, while oil price movement leads the movement in gold (see further below the year to date 2020 charts for silver, gold and oil). It appears that oil is lagging behind both silver and gold in price action so far in 2020 - at least when seen in terms of being close to the highs year-to-date. i continue to see an opportunity for oil to (a) close the gap between 39 and 45, and (b) head back in to over 65 dollars before the year is out (see (c) on the right side of UPCOMING POSTS).

METALS #4 - ENERGY #6

(Great Double Stitching Up Top - Good As Gold)

Upcoming Posts:

(a) An options structure to profit from a move up in the price of Platinum. Two strategies: a play on the outright price and a play on the spread versus Gold.

(b) Long term options structure to profit from a move to over 100 dollars in Brent by mid-2022. based on the mean-reversion of the gold-oil ratio.

(c) Update on the ICE Brent Options Structure previously discussed in Oil Post Number Two.

20Y Data - Gold:Brent Ratio

Silver Chart - 2020 YTD

Gold Chart - 2020 YTD

Brent Chart - 2020 YTD