There are at least 4 studies testing the cointegration or long-term equilibrium of the correlation between gold and oil.

10 June 2020

In my previous post I posit the following regarding the gold:oil ratio:

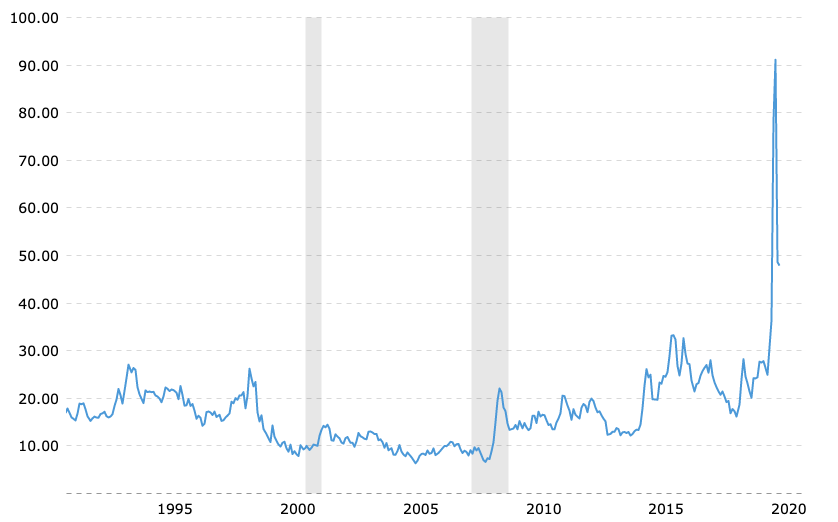

Assuming mean reversion (to 17:1 ratio) and a price of 1,700 for Gold, Oil is headed for (at least) 100 dollars a barrel (possible overshoot to 14:1, i.e. 120 dollars a barrel / timeframe target = within two years).

Caveat: Where gold to return to (say) 1,000, at 17:1 ratio this would imply an oil price of around 59 dollars. This is still 17 dollars over the current price (10 June 2020). At 14:1, that would give an oil price of just over 71 dollars.

I site the following 4 academic papers that theorize that gold and oil are cointegrated well:

1. The Crude Oil market and the Gold market: Evidence for Cointegration, Causality and Price Discovery (Zhang, Wei - September 2010);

2. Oil and Gold Price Dynamics in a Multivariate Cointegration Framework (Beckmann, Czudaj - April 2013);

3. An Investigation into the Dynamic Relationship between Gold, Silver and OIl: An Intraday Analysis (Blinov - 2013);

4. Cointegration and Causality among Dollar, Oil, Gold and Sensex across Global Financial Crisis (Singh, Sharma - December 2018);

In other words, gold and oil exhibit long-term equilibrium and hence (in theory of course) mean reversion. I will continue to propose back end purchase of call options on Brent versus short end sales of put options on Brent. This achieves three things: positioning long Brent prices, exceptionally positive time decay (as the implied volatility bias against calls continues to exist), and long vega (a mitigating hedge against perhaps another severe sell off in prices).

METALS #3 - ENERGY #5

Upcoming Posts:

(a) An options structure to profit from a move up in the price of Platinum. Two strategies: a play on the outright price and a play on the spread versus Gold.

(b) Long term options structure to profit from a move to over 100 dollars in Brent by mid-2022. based on the mean-reversion of the gold-oil ratio.

25Y+ Data Chart - Gold:WTI Ratio