METALS #16(a) - Taking Stock of the Pt-Pd-Au relationship move since my first post on this back in 2020 (8th June - Metals Post #1 (https://mantaoilco.com/metals-post-no-1/))

11th December 2023

SUMMARY

It has been a while since my last post (nearly two years ago, 16 Jan 2022; Subject: closing an oil options position/strategy), thus I would start where I began, i.e the precious metals complex:

TO SUMMARISE THE RELATIONSHIPS OVER TIME:

- The old heirarchy (established over a long period of time): Pt top, Au second and Pd third.

- The previous heirarchy (lasted in recent years): Pd top, Au second and Pt third.

- The current heirarchy: Au top, Pd second (but only just) and Pt third (and in my opinion...not for long)

I believe that the old heirarchy is primed to return:

1. Pt on top; Au second; and Pd third (where it belongs).

2. The lasts time Pd was still below Au and on its way to parity with Au was in 2018.

3. The main mover is Pd. Au has moved too but not to the same degree (albeit in the opposite direction - i.e. up). Pt has been slower on the upside but that is where I see the potential.

NEXT STEPS (NEXT POST)

1. Statistical analysis of the time series of Pt, Pd and Au. I will be searching for the existence of any mean reversion (i.e. revert back to the old order) and cointegration (if all three metals exhibit long-term equilibrium with one another).

2. Analyse the current implied volatility market for all three metals:

(a) Looking at At-the-Money Implied Volatilies for near-, medium- and long-term expiries (i.e. front and back end options), and

(b) Looking at the current risk reversal (25 delta and 15 delta) implied by the market for near and long-term options.

3. Anaylyse there models to calculate historical volatiles and see how that compares with the market implied volatilities. i will limit my time series to 10 years of data ending last friday 8th December 2023.

4. Develop (if possible) an options strategy that will benefit from a reversion to the old order whereby Pt > Au > Pd.

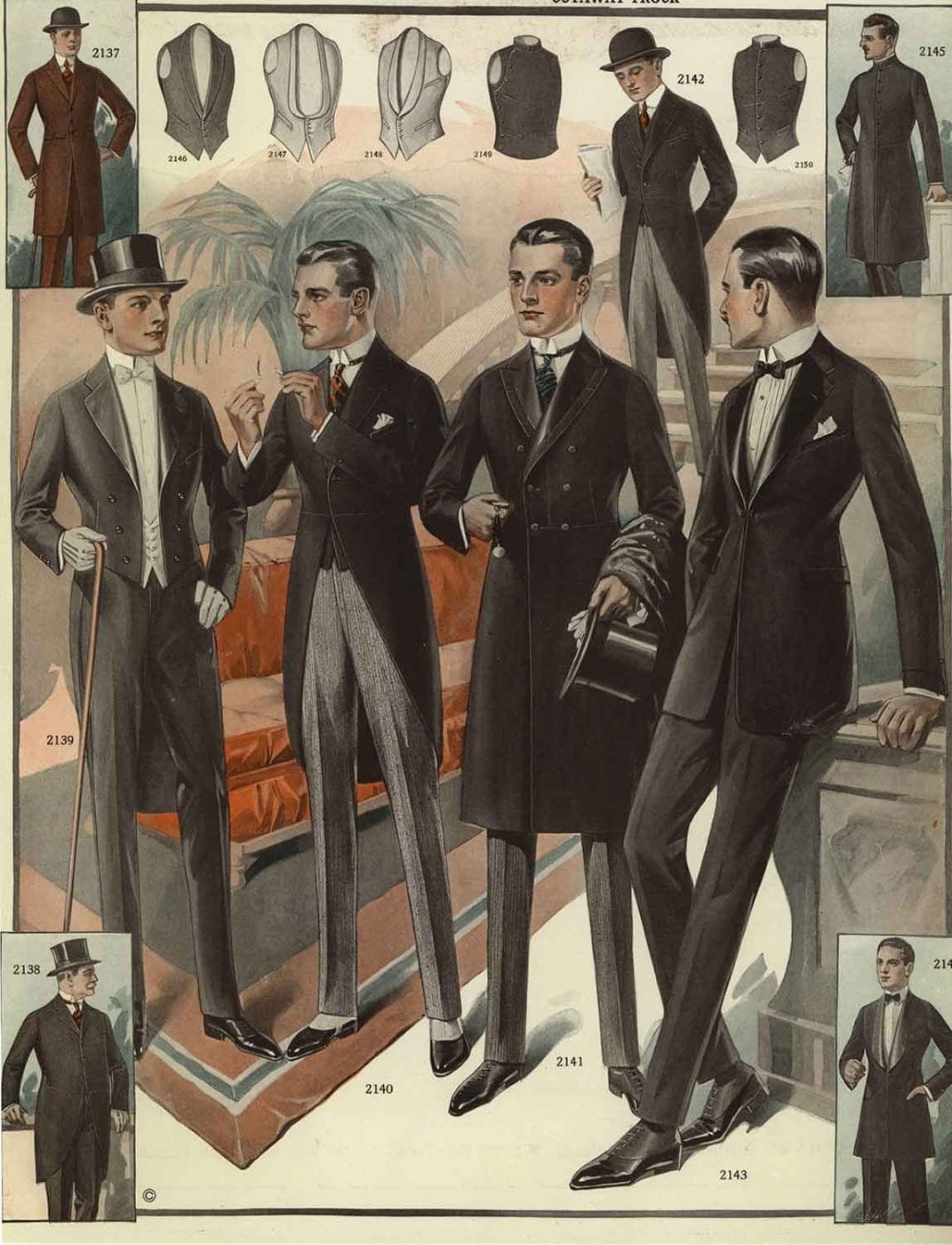

To win...proper formal attire required.

OBSERVATIONS

Observe the charts below.

1. The most telling chart is the last one (Palladium-Gold). From extreme positive in favour of Pd to the opposite (i.e. now significantly in favour of gold).

2. Second most telling chat is the Palladium-Platinum chart (Chart 3). Stunning how this chart has developed since 2008 (from one end of the spectrum to the opposite end). Are we seeing a return to those levels of 15 years ago? More interesting is whether Pt can catch up with Au.

3. And of course, on its own, the Palladium chart is the reason for this reversal to the start (my view) of the return to the old order (Chart 2).

4. Platinum clearly has been somewhat range bound and lazy in terms of movement. Quite the opposite to Gold which has made a significant move upwards (I know that there are those that will site fundamentals with regards to this but my posts are focused more on technicals). Platinum has been "stuck" and I believe that its turn will come in 2024 (similar to what gold has done - and perhaps even moreso).

**** Strategy using options to return to the old "order", whereby Platinum will revert to being "top dog", gold in second and palladium in third (in the next post).

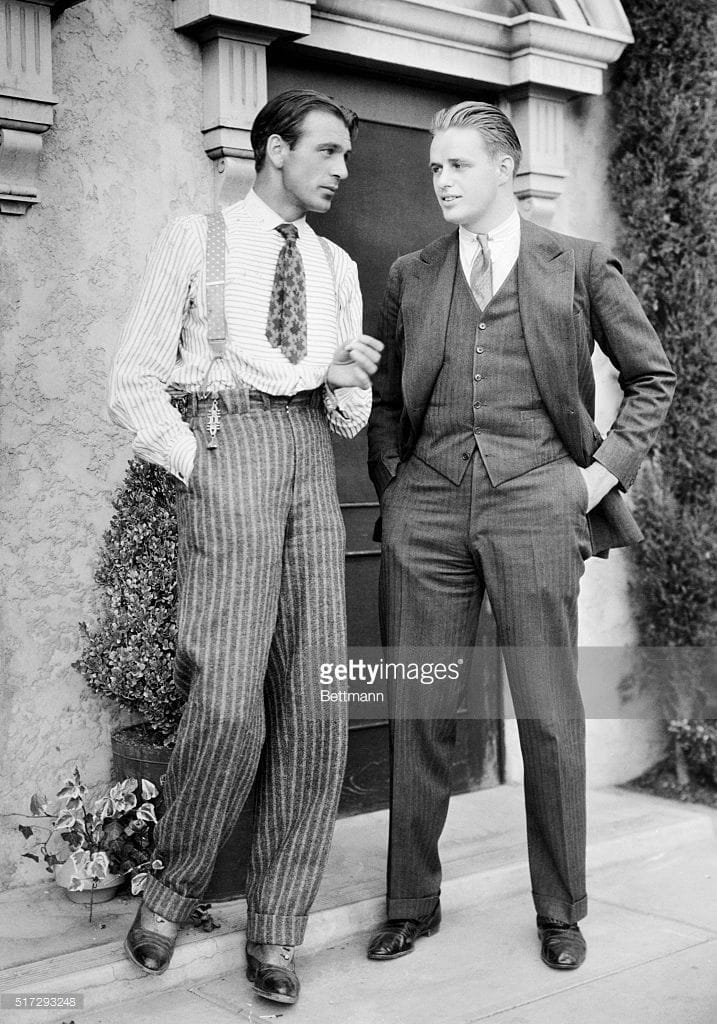

I love thick cuffs! Check out GC vs FDRjr.

Weekly - Platinum

Weekly - Palladium

Weekly - Palladium-Platinum

Weekly - Palladium/Platinum (ratio)

Weekly - Gold

Weekly - Palladium-Gold