PROFIT TARGET SURPASSED!

16 January 2022

Time to take profit on our open options positions (3 legs)

Our open positions are the following:

1. Short a March 2022 WTI 60 Put (shorted at a price of 5.86). Current price to buy back = 0.19.

2. Long a November 2022 WTI 85 Call (purchased at a price of 4.63). Current sell price = 6.45.

3. Long a December 2022 WTI 90 Call (purchased 16 June 2021 at a price of 1.29). Current sell price = 5.22.

The initial option structure initiated in 16 June 2021 took in a net premium of 0.25. The following structure initiated on 1 December 2021 took in a net premium of 1.23.

As per closing prices of 14 January 2022, closing our open positions will receive a net of 11.48. Adding in the premiums received of 1.48, gives a total profit of 12.96. That is, USD 12,960 per each lot of the structure initiated.

** PLEASE REFER TO MY POSTS OF 16 JUNE and 1 DECEMBER 2021 FOR THE VARIOUS REASONS BEHIND THE STRUCTURE.

METALS #15 - ENERGY #17

Valentino time - i.e. taking profits!

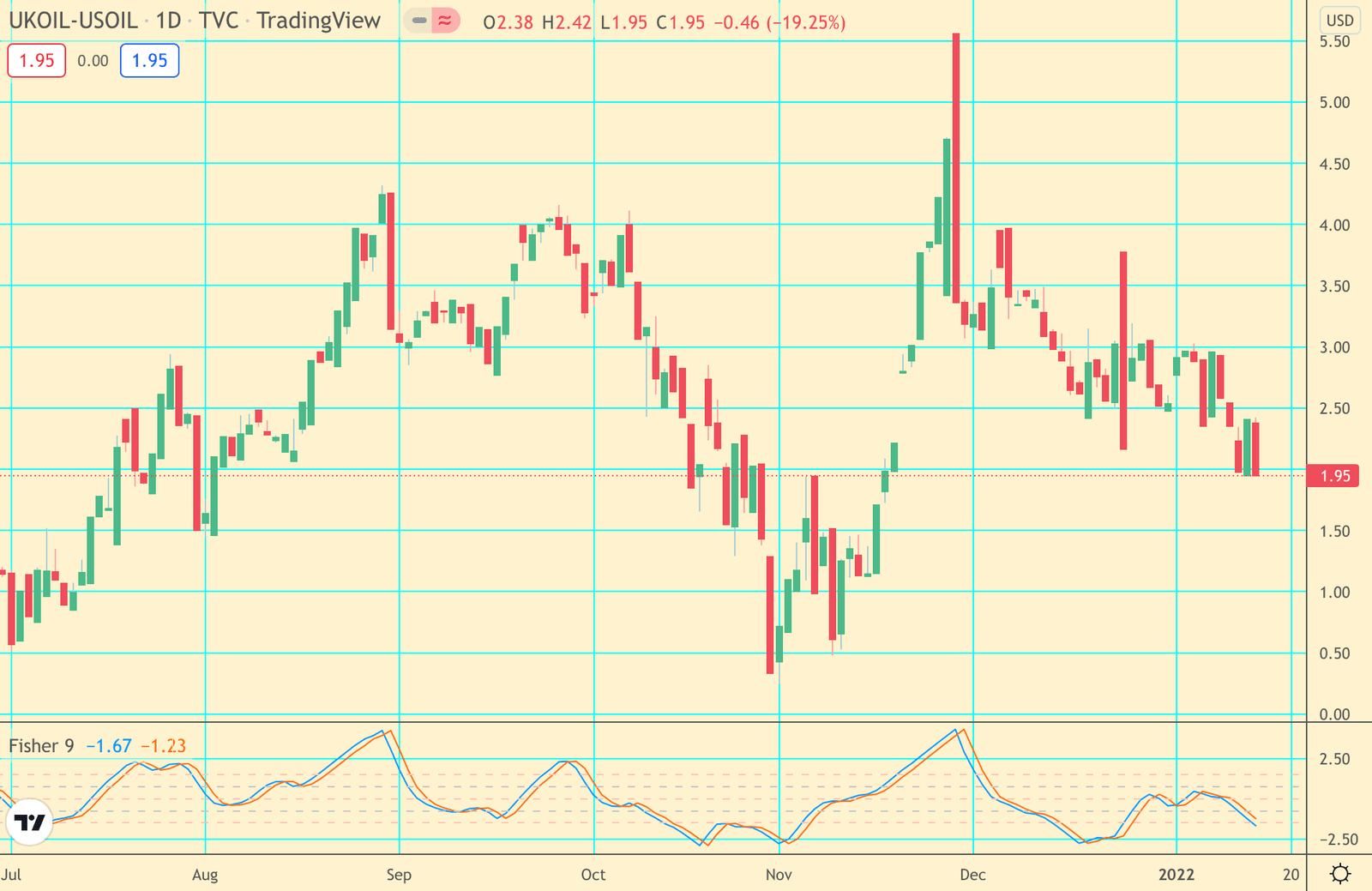

(a) Excellent cointegration of Brent and WTI and the long-term equilibrium of the spread.

(b) Cointegration of the volatilities between Brent, Gold and the Gold:Brent ratio. It is the price of Brent that moves more to correct the Gold:Brent ratio back to its long-term equilibrium level.

(c) Profit of USD 12.96 (USD 2.96 more than our target of USD 10 (as per my post on 1 December 2021).

Daily - Gold:Oil Ratio

Daily - Brent-WTI Spread