BACK ON THE HORSE!

1 December 2021

The last 3 trading days has created (once again) the same opportunity in options as that of last March/April 2020.

The last proposed structure initiated on 16 June 2021, that is, sell a 56 WTI November 2021 Put to buy a 90 WTI December 2022 Call, taking in a premium of 25 ticks has resulted in the ownership of the 90 Call without the risks of downside short option. Why? Because the 56 WTI November Put expired worthless on 16 November 2021.

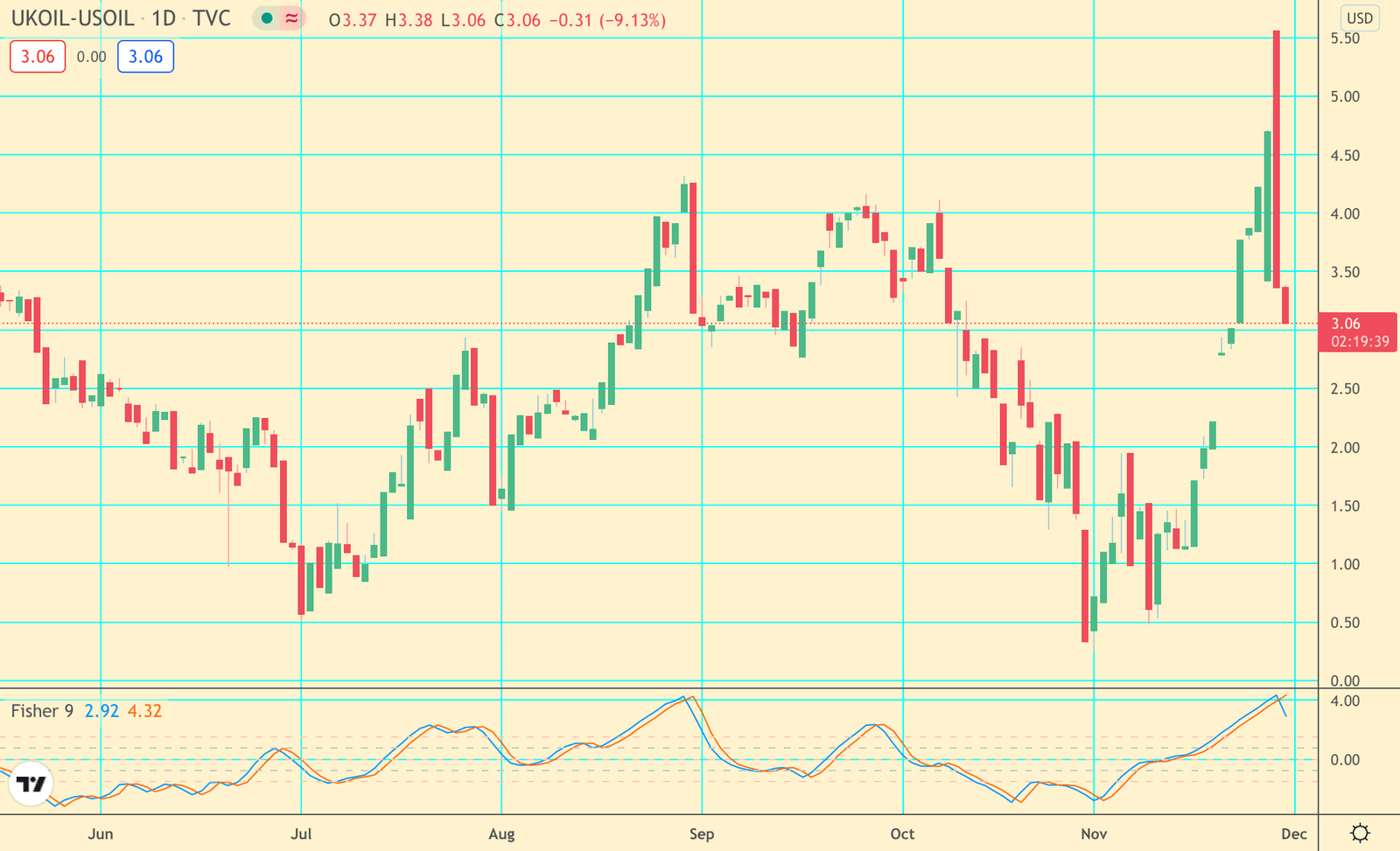

During the last three trading days, we have once again the ridiculous implied volatility prices of near month options versus back dated options go panicky; as well as, put options versus their call counterparts (i.e. risk reversals). Even the gold:oil ratio has blossomed (see chart below), however, not in the same insane way as early last year.

The following option structure is proposed to take advantage of this hysteria of the gold:oil ratio to (still) the long term target of 12:1 (assuming gold maxes out at $1900 over this period, this would equate to a Brent price of over $150). However, this strategy will limit itself to our often said (for the last year or more now) 18-month Brent target of $125.

30 November 2021 closing prices for the strategy:

1. Sell March 2022 WTI 60 Put, Expiry 16 February 2022, premium received = 5.86. Futures reference = 65.49.

2. Buy November 2022 WTI 85 Call, Expiry 17 October 2022, premium paid = 4.63. Futures reference = 62.82.

Structure receives premium = 1.23. Net Delta -4.6, net Vega = +0.0591, net Theta = +0.0127.

Note: our structure still includes a December 90 WTI Call. That is, in our portfolio we have a short March 2022 Put (60), long November 2022 Call (85), and long December 2022 Call (90).

METALS #13 – ENERGY #16

Let’s Go For a Ride – Further thoughts:

(a) Excellent cointegration of Brent and WTI and the long-term equilibrium of the spread.

(b) Cointegration of the volatilities between Brent, Gold and the Gold:Brent ratio. It is the price of Brent that moves more to correct the Gold:Brent ratio back to its long-term equilibrium level.

(c) Implied volatilities and risk reversals (puts versus their call counterparts) give us an opportunity to be positive time decay whilst being nearly short vega. This does not happen more than once a year (if that).

(d) What is our exit strategy/target profit? 10 dollars. Currently we have 4.04 dollars in the kitty (assuming the sale of our Dec 90 Call). However, we still have to manage the short leg risk in the meantime. Stay tuned.

Daily – Gold:Oil Ratio

Daily – Brent-WTI Spread